This is what happens when you respond to SPAM Email…

I am an avid TED Talks watcher and just came across this Talk. It's hysterical and I suspect will give you pause too! It's also hilarious!

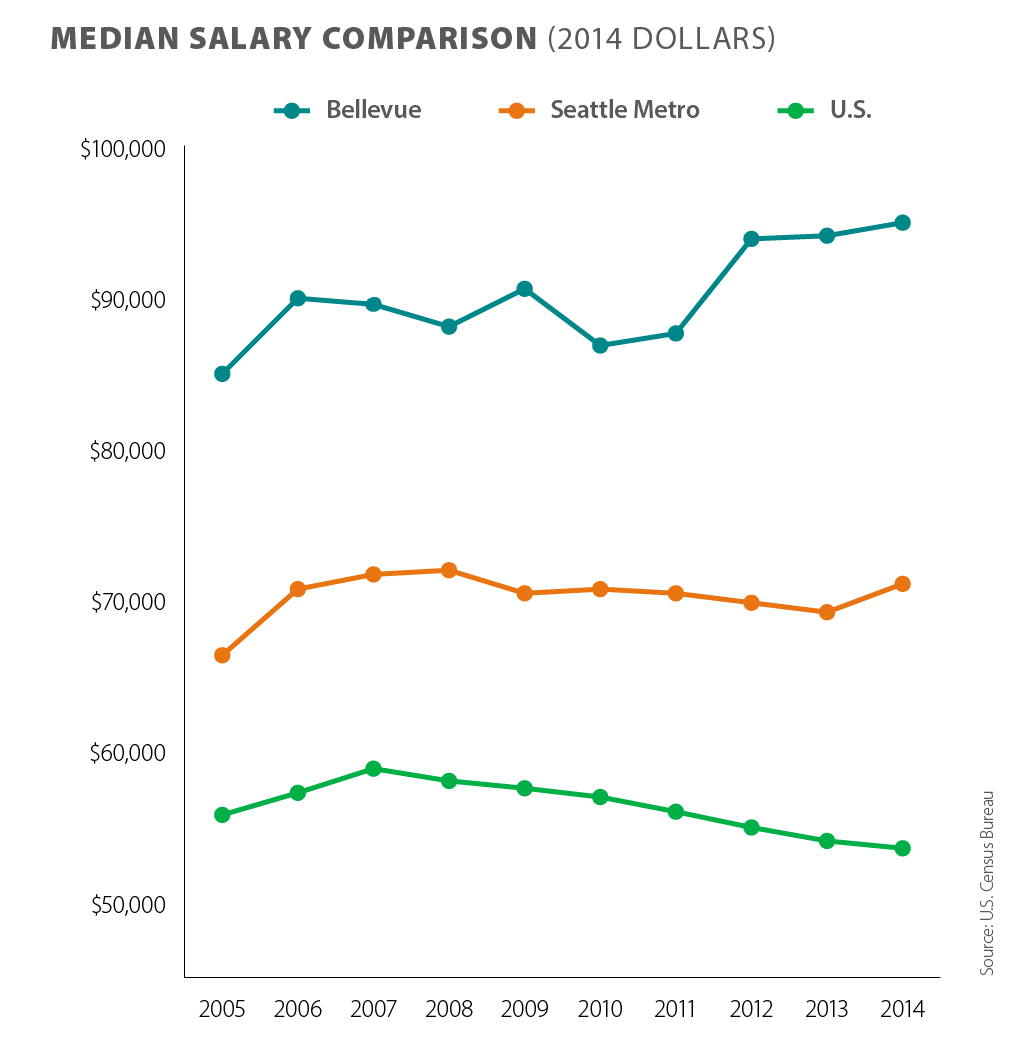

No Wage Stagnation on the Eastside

Wages on the Eastside are up

Last month’s U.S. Census report showed that middle-class incomes nationally were stagnant, confirming a trend that has been widely reported. But when 425Business magazine crunched the numbers for a local perspective, the picture changed. Unlike the U.S as a whole, median incomes in Bellevue and the greater Seattle area have risen – and wage growth has been particularly strong on the Eastside. A booming technology industry has made the Puget Sound area’s economic growth a standout.

Home prices soar as well

A steady influx of well-paid tech workers has boosted the local real estate market. With an increasing demand for homes, and not enough supply to meet the need, home prices have soared this year. The latest figures from the Northwest Multiple Listing Service show the median price of a single family home is up 10 percent over last year. If you’re considering selling, you’d be hard-pressed to find a better time to get top dollar for your home.

No Need To Panic About Rising Interest Rates

This article originally appeared on Inman.com

After seven years of some of the lowest interest rates in recorded history, the Federal Reserve has decided to raise the key Fed Funds Rate by 0.25 percent, which is causing some to be concerned that it will lead to a jump in mortgage rates and negatively impact the US housing market.

So, the question everyone wants to know is, do we need to worry about interest rates leaping?

While I expect there to be some volatility in rates for a while, I don’t believe the real estate market will implode in a rapidly rising interest rate environment. So, yes, interest rates are going to rise modestly, but no, I don’t think we need to be overly worried about it.

To qualify this statement, we need to understand that mortgage rates do not run in “lock-step” with the Fed Funds Rate. Although the Fed Funds Rate is a bellwether for the greater economic environment, there have been times when these two rates have moved in opposite directions, such as we saw in 2004/2005.

It’s also important to understand that while interest rates for revolving credit, such as credit cards and home equity loans, are tied to the Fed Funds Rate, non-revolving loans – like mortgages – are not. Mortgage rates are tied to bond yields – specifically the 10-year treasury.

So what do I think will happen?

I believe interest rates will rise above 4 percent, but we will not see a sharp spike in rates. The Fed has stated that any upward movement in the Fed Funds Rate will be slow and steady, and will reflect the greater economy. And I believe that mortgage rates will follow suit. Additionally, mortgage rates have already moved higher in anticipation of an increase in the Fed Funds Rate.

That said, it is worth noting that any weakness in the global economy can actually have a downward effect on interest rates. This is referred to a “flight to quality”. In essence, investors seek safe haven during times of economic uncertainty. If markets outside the U.S. continue to underperform, there will likely be increasing demand for bonds which will drive up their price and drive down interest rates. Between China, the Eurozone, war in the Middle East, and a massive drop in oil prices, it's certainly possible that the price of mortgage backed securities could rise, leading U.S. mortgage rates lower.

Interest rates could not realistically stay at their current levels forever. But an increase should not be a great cause for concern. Yes, an increase makes mortgages more expensive, but not to a point where they will have a negative effect on home values. That said, the rate of home price growth will undoubtedly slow in the coming year, but that isn’t necessarily a bad thing.

A little perspective might help: the average rate for a 30-year loan in the 1970’s was nine percent. It was 13 percent in the 1980’s and eight percent in the 1990’s. And yet people still managed to buy and sell homes throughout those years. With that in mind, the rate increases we’re likely to see in 2016 are nothing to fret over.

The increase in the Fed Funds Rate should be taken as a sign that our economy is expanding and is a preemptive move to limit anticipated inflation. While interest rates have risen from their all-time low, they are still remarkably favorable. And will remain so through 2016.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

No national bubble in sight, but there are some frothy markets

This article originally appeared on Inman.com

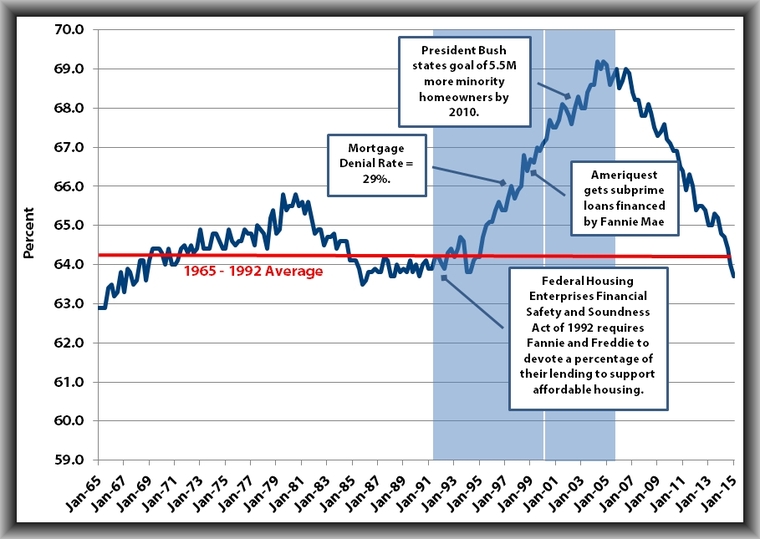

Earlier this year, I wrote an article called “No housing bubble in sight — for now” in which I shared my belief that the nation, as a whole, is not currently at risk of seeing another housing bubble.

However, I did qualify that statement by saying that I was noticing some “frothy” markets around the country that might be getting a little too hot.

In this article, I plan to divulge those markets that are likely to see slowing price growth in 2016 and possibly a downward correction.

The primary data sources that I used for my analysis were the Case-Shiller Index and the Federal Housing Finance Agency (FHFA).

I chose these two providers as they both prepare indices on home values using the repeat sales method. That is to say, they use data on properties that have sold at least twice to capture the true appreciated value of each home.

What the data shows

As I studied these data sets, it became apparent to me that there are some markets that we need to watch. From a very simplistic standpoint, both Case-Shiller and the FHFA indicated a few cities that have already surpassed their peak index levels.

Using the Case-Shiller numbers, these were Dallas, Denver, Portland and Boston. The FHFA data showed Dallas, Atlanta, Charlotte, Portland, San Francisco and Seattle as having surpassed their previous peaks.

While this can certainly be an indicator that a market is getting overheated, it’s not the be-all and end-all because external influences, such as mortgage rates and recessions, can all affect index levels.

Because of this, I thought it was important to take a closer look and focus on those markets that might be tracking above their natural trend.

That’s to say, I looked at pre-bubble growth rates, forecasted that rate forward in time and then compared that number to the present index levels.

After having completed this analysis, San Francisco, Denver and Dallas appear to be appreciating at a faster rate than their historic averages.

Even two indicators that point toward a potential problem don’t guarantee an outcome. Because of this, I decided to round off my analysis by looking at the ratio of home prices to incomes in the market areas that were of interest.

This is another important indicator when determining the health of a housing market as it speaks to affordability.

For the past few years, home values have been rising at rates well above that of incomes, but thanks to low-interest rates, this hasn’t yet created a significant barrier for buyers.

However, mortgage rates are set to rise, and this could leave some markets with homes that are too expensive for buyers earning that area’s median income.

When we look at the world through this lens, the cities where I see a cause for concern are San Francisco, San Diego and San Jose.

So what does this all mean?

Well, for one thing, San Francisco stands out — and not necessarily in a good way. Additionally, several markets have recovered from the housing collapse, and they are getting a little ahead of the rest of the country; specifically Denver and Dallas.

I will be watching these markets closely and anticipate that we might see a relatively steep slowdown in home price growth in these three cities.

The U.S. housing market has spent the past three years in recovery mode with robust demand, tight supply and favorable interest rates, which created a perfect environment for prices to rise — and rise they did.

However, I believe that a select few markets, such as San Francisco, Denver and Dallas, are getting a little out of sync and should start to prepare for an almost certain slowdown in price growth.

Now, if there is any consolation, it’s that the slowdown is supply-driven. If we do not see a significant increase in inventory in these markets, any slowdown in home prices might be offset by persistently high demand. Only time will tell.

3 Quick Maintenance Tips To Make Your Roof Last

Your roof is one of the most important assets of your home. Here are some tips to help maintain it.

This article originally appeared on Porch.com

A brand-new roof is a massive investment, but no other element of your home is quite as valuable. While the average lifespan of a roof is about 15 years, careful homeowners have a few ways to extend the life of their homes without enduring too many headaches. Take a look at these three quick maintenance tips that will make your roof last.

1. Keep Your Gutters Clear

Most people don’t think of their gutters as part of their roof, but allowing debris to accumulate and clog your gutters adds extra weight and pulls away at your roof’s fascia, which can be a costly fix. Look down the length of your roof for any signs of sagging or bending – that’s a sure sign your gutters are carrying too much weight and pulling at your roof. Downspouts should also be carefully maintained, but don’t be fooled by easy-flowing water. Moss and algae buildup on and around your roof can slowly eat away at your roofing material and severely compromise its integrity.

2. Focus On The Attic

The exterior of your roof isn’t the only area you should be focused on. Your attic is your roof’s first line of defense against damage and you have two methods of attack: insulation and ventilation.

Insulating your attic has the double benefit of keeping your home’s internal temperature at a more reasonable level while also preventing vapor and moisture buildup on the underside of your roof. When combined with proper ventilation (which may mean adding a fan to your attic), your attic can stay dry and keep your roof’s rafters safe from moisture damage.

3. Catch Problems Early

Check on your roof regularly, whether it’s with every change of the season or after a significant storm. Catching small issues early on can only save you money in the long run, so utilizing the services of a reliable, professional roofer is an invaluable asset. As with any working professional, it’s a good idea to establish a working relationship with a roofer and even consider scheduling a yearly checkup for your roof just to make sure there aren’t any problems sneaking up on you. After all, spending a little each year to maintain your roof is a lot better than dropping $15,000-$50,000 on a new one, right?

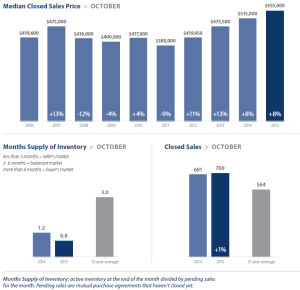

Local Market Update – July 2015

The housing market last month heated up significantly. Along with temperatures, the housing market sizzled in June. Continued low inventory coupled with ever-increasing demand pushed home prices in King County to an all-time high. The multiple offers and escalation clauses that have now become common make it a very hot market for sellers.

- Home prices in King County surpassed their 2007 peak.

- The number of closed sales in King County increased 17 percent over last June.

- Record low inventory continues to fuel competition among buyers.

Eastside

While sales on the Eastside jumped 23 percent, inventory remains very tight. With very little new construction in the pipeline, low inventory is expected to continue until more sellers are willing to list their homes. An incentive is the continued price appreciation here. The median home price was up 6 percent to $670,000, the highest of any King County region.

King County

There were almost 24 percent fewer homes for sale in June as compared to the same time last year. As a result, competition for homes is fierce, with first-time home buyers competing with foreign buyers and those moving here for new jobs. King County saw the median price of a home soar 10 percent over last June to $500,000 – an all-time high.

Seattle

Seattle continues to have the greatest shortage of inventory in King County, with just over two weeks of available homes on the market (3-6 months in considered balanced). Unlike the outlying areas of King County, Seattle has very limited land for new development. High demand from relocating tech workers helped drive home prices up 15 percent to $575,000.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link